Customer Service Hotline: 0408 763 663

You may have heard some people talking about shares in one company and then another group of people talking about stocks in that company and wondered what the difference is. In reality the terms "stocks" and "shares" mean the same thing, the two terms are interchangable however the prevalent term in Australia has traditionally been "shares" whilst in the U.S. they are predominately called "stocks".

Options including "calls" or "puts", can be both bought and sold. Exchange Traded Options gives you the right to buy or sell a particular share at an agreed price (the exercise price) on or before a specific date (the expiry date). When you exercise the option, you take up your right to buy or sell the share.

A call option gives the buyer the right but, not the obligation, to purchase shares (from the seller) at an agreed price within an agreed period sometime in the future, often 1 or 2 months.

A put option gives the buyer the right, but not the obligation to sell shares (to the option seller) at an agreed price within an agreed period sometime in the future.

A covered call is offering shares you own for sale at an agreed price on or before an agreed date, often 1 month or more in the future.

For example: if you own 1000 OSH (Oil Search) shares which you bought @ say $3.40 each ($3,400); you can offer to sell those shares at a strike price of say $3.50 each, in one months time. A buyer pays you a premium, for the offer [contract], not the shares, of say 90 cents per share ($900 per 1000), which you get straight away and get to keep. The buyer may exercise you at any time until the end of the month which means you must sell your 1000 shares @ the strike price of $3.50 ($3,500). If the buyer chooses not exercise you (usually when the shares remain sideways or go down), you keep the premium and the shares to write options over again next month.

Because shares can only go up, down or sideways, then its probable that you will not be exercised, most of the time; because you will only, normally, be exercised if the shares go up.

Covered calls can be traded on-line or via a stockbroker(s).

Good question. There is risk with covered calls which is probably best defined by discussing the likely outcomes of covered call trading.

If the shares offered in the call go up, you will probably be exercised. You will receive the strike price for your shares plus keep the premium. You will miss the opportunity to capitalise on the share gain. Remember you may also pay brokerage.

Some people consider writing (selling) covered calls less risky than just buy and hold stock strategy. Writing options has outperformed just owning shares alone.

Because I have to pay for each person using the data during the free trial. Most ‘trialists’, the masses, don’t know what covered call options are and are looking for someone to take their money to train them to become an expert overnight. Sorry for being so cynical. They try My Covered Calls, for free, don’t understand options (and have no patience to learn via reading, paper trading and asking questions); and unsubscribe. I still have to pay for their data during the trial and this can quickly add up as more and more people hear about the high returns of covered call trading...and try my service for free. Fortunately those people who do trade call and put options often become valued Members.

There is a bunch of free information online. Start with the ASX web site. It has heaps of free information and training spaces. Also Comsec has a lot of great information. Call me, Tony, on 040863663

The following is an example from memory. Prices may not be exact.

During the GFC BHP prices dropped from about $35 on 1 Aug 2008 to about $24 on 1 Oct 2008. Those people who bought at $35 around Aug 2008 and sold a $35 option earning say 3% found at the end of the option contract period the share price was about $27. They let the option expire. They still owned the shares in BHP @$35. They keep the Premium (3% of the share price x number of shares held) and will also receive share dividends, say 5%, while they own the BHP stock.

In the above example there are a couple of choices:

Then Write another option ATM, about $25, for Oct/Nov 2008; earn income of 3%. Return now 17%. Outcome: Option got exercised as share price closed at the end of the contract period at about $26. Action: Buy the stock back at $26 meaning you now own the BHP shares at @36. BHP shares had recovered to about $37 by 1 Dec 2009, bit over a year since the GFC date, in this example from 1 Aug 2008. Overall 17% to 19.5% on investment in 15 months if picked up an interim dividend before selling the shares.

One of the key things I look for when buying the underlying shares is Bluechip stock… “They are the biggest companies by market capitalisation on the stock market”... so I will be happy to hold the stock for some time if needed. Over the last 15 years I have had to hold some stocks for longer than a year but on only a few occasions. During this period, I had sold an option(s), earned the Premium income and collected the share dividends throughout.

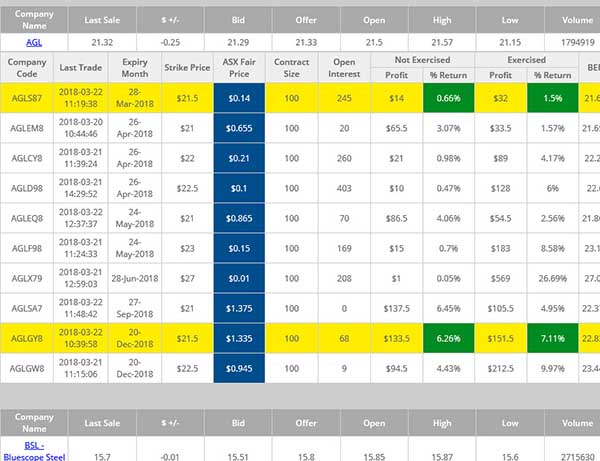

Click to see live BHP, BSL & TLS sample smart report showing Not-Exercised and Exercise Returns. All Companies available in Members Area.

Tony Osborn - Team of One

MyCC is provided as a service to its members. Small, niche, exclusive and operated since 2006.

© My Covered Calls Pty Ltd. All rights reserved. ACN: 125 141 344