Customer Service Hotline: 0408 763 663

COVERED CALLS - THERE IS NO MAGIC A Common Dog approach to writing (selling) Covered Call Options

If you don't know what a covered call option is then spend a little time at least understanding the basics, see www.investopedia.com/articles/optioninvestor/08/covered-call; they do a pretty good job of discussing the basics. Once you understand the mechanics of buying shares and writing a covered call options then read on... I am discussing how I have been successfully trading covered call options for over 16 years. What's in it for you; to learn about covered call options, for free; and maybe choose to use this strategy to generate more income from your share portfolio. I use a very simple approach. Buy shares in good Australian companies (usually ASX Top 50) and sell (Write) covered call options over those stocks with good option Yields. My risk is that I may own shares in a Top 50 company for some time, however, still recieved dividends as well as the option premium(s).

While this page is under development, if you have any questions please call me on 0408763663, Tony. My Covered Calls is an ASX option screener, data service and Trading Plan system; and has tools for people who trade covered call options for income and profit.

The strategy is to buy shares and sell [write] an option contract to on-sell those shares at a future date. You get paid for selling the contract. My Covered Calls shows you in its reports on the web page and in ProWriter (Trading Plan software), how much you would get paid for selling the contract. You derive income by selling the contract not necessarily from the share price movement.

A number of people have asked me about training/education about the covered call strategy so I have created the Beginners Guide and will continue to work on developing the guide. [I had a bit of a setback, working on my web page development, during 2023 as I contracted men's breast cancer and spent all my time doing chemo/radiation etc. In remission now but happy to talk about it to help raise awarness of men's breast cancer]. My Covered Calls has been going continuously for over 16 years, so we must have got something right, and I hope to impart some of that experience in the Beginner's Guide via a bunch of short videos.

Also, I have been away for a couple of weeks as I do volunteer farm work with Rural Aide to help some farmers out West, QLD. The videos below are old ones and are temporary for now. Notwithstanding, there is a lot of information already on the site and a lot of free information on other sites like www.asx.com.au and Comsec.

Any questions please call me, Tony on 0409873663.

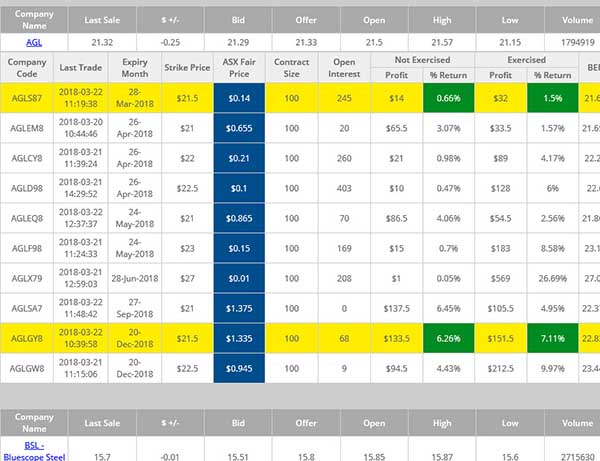

Covered Call options Trading Plan software. Free from My Covered Calls. This is a test video so don't expect too much but it is using real data and is fair dinkum about how to create a trading plan for writing covered calls options for income. What is an Option? An option could be described as a contract between two parties, a buyer and a seller, where the seller agrees to “sell” shares to the buyer at a future date for an agreed price. The buyer pays the seller a “premium” for the “option” and “right” to buy the shares. What is a Call Option? A call option is the right but not the obligation to buy a parcel of shares, usually 100; at a predetermined price within a specific period of time. A contract is formed between a buyer and a seller for the shares that says the seller will sell the shares at the agreed price to the buyer if and when the buyer says so. If the buyer has not purchased the shares at the end of the specific period of time, then the option expires worthless. You keep the premium. In Australia, each contract is for 100 shares. A covered call is when an option is sold on shares you currently own. ProWriter lets you create a Trading Plan to document what shares you may buy and what your return will be from the Premium for selling the option contract.

Test Document - https://mycoveredcalls.com.au/yt-assets/test-doc.pdf

A quick presentation on covered calls from www.mycoveredcalls.com.au

How My Covered Calls got started. I wanted to trade ASX listed covered call options but needed information like share price, strike price, open interest, contract size, premium and the return if exercised or not exercised; so developed software to present this information in and easy to read format covering all available options on the ASX. This data then populates the ProWriter software and produces a Trading Plan based on factual information.

Click to see live BHP, BSL & TLS sample smart report showing Not-Exercised and Exercise Returns. All Companies available in Members Area.

Tony Osborn - Team of One

MyCC is provided as a service to its members. Small, niche, exclusive and operated since 2006.

© My Covered Calls Pty Ltd. All rights reserved. ACN: 125 141 344