Customer Service Hotline: 0408 763 663

Get started by 'Paper Trading'. Paper trading is doing the same actions you would do if buying shares and writing options except you don't click the BUY button but enter the actual prices into ProWriter (free Trading Plan software) of what you would have paid. Then using actual live data, from Comsec*, enter the actual price you would have sold the option at into ProWriter. Watch the movement of the share and option prices from time to time during the contract period to see how effects of time decay and price movements have on the option Premium, and finally note how the plan performed at the end of the option contract period. Simply: create a Trading Plan with ProWriter using its reports: click Yield...Short List...Trading Plan, then up date the Trading Plan using live data from Comsec and wait until the end of the contract period to see the outcome either Exercised or Not-Exercised. You can practice Paper Trading anytime using end of day data, however, its a better experience when the market is open and to see live data via Comsec or other platforms.

I find the most challenging part of trading covered calls is understanding the process which I thinks has little to do with investment decisions. The data shows us that if you buy shares and write (sell) and option over those shares you will be paid a premium, and often this can represent a very good annualised return. See the MyCC Smart Report to the right of this screen.

The shares you buy and the options you write are your decision. However, My Covered Calls and ProWriter software presents you with factual data which you may use to help you decide, and plan your option trades. Very important.

This section is going to show you how to paper-trade covered call options using My Covered Calls [ProWriter] to develop your Trading Plan, and how to execute the plan with Comsec. Paper-trading means you go through the planning process as you would for live trading and also follow the execution as you would for live trading but stop just before you actually buy any shares and write an option. However you record the actual live prices, as if you had traded, and follow the contract to expiry to see the actual outcome. This grows your experience in trading with out risking your capital. You can Paper Trade every day to gain experience in the covered call option process, understand a strategy and see actual outcomes.

PAPER TRADING – WRITING COVERED CALL OPTIONS

This module outlines how to “paper trade” writing covered call options. Please note that the same strategy is also used for live trading.

Covered Call Writers, Buy Shares, Sell Options and Get Paid. A Covered Call Writer or “Call Writer”, is someone who sells an option contract to someone else to buy the Call Writer’s shares. How does this work? If you own or buy shares, the share price can only go up, down or stay the same. Other people may believe the share price will go up, however, they may not have the funds to buy and hold the shares and then hope for the share price to go up to take a profit; so they may pay you a Premium, say 2% to 2.5% of the share price, to give them the right to buy your shares during or at the end of the contract period (which could be 30 days); at the price you both agreed, the 'Strike' price. If the share price does go up, the option buyer may then Exercise the option; that is, buy your shares at the Strike price and choose to sell them at market and take a profit. You get your money back for the shares and keep the Premium. You always keep the premium, whether exercised or not. The buyer’s risk is the Premium which they paid you and you keep. Your risk is you hold the underlying stock.

Covered Call Writing could be considered a low-risk trading instrument because you already own the underlying shares and are merely selling options on those shares. Writing covered calls is an option related strategy which may be appropriate for Self Managed Super Funds (SMSF).

This module is in two parts:

Part 1. Five Trading Steps for Writing Covered Calls

It’s very hard to learn to play professional sport by reading a book. You need to practice. Given that you already have an understanding of the Australian Share Market; a good way to practice Writing Covered Call options is to create a pretend trading portfolio, which is known as “paper” trading.

Rationale. Writing Covered Call Options is considered a low-risk trading instrument, however, share market trading is not predictable and past results cannot guarantee future performance. Paper Trading is a reasonable way to gain valuable experience trading covered calls without having to actually buy shares. It is, however, important that you trade as realistically as possible to gain the best practical experience, by using real prices and other ASX derived data.

This part discusses the five trading steps used to trade covered call options, namely:

The above process is from a proven live trading strategy, I have used for over 16 years, and applies equally well for paper trading.

Fundamental to successful paper trading is to follow a process as close to live trading as possible. Decide how much virtual cash to invest. Be realistic and choose an amount that you may reasonably invest into live trading. This process is expanded on later in this module under the topic of Successful Trading Strategy

Yield

XYZ Company Last Sale Price $21.92

Last Sale [Premium] value $0.59 (X 1000 = $590)

Ex Price [Strike] price $22.00 (at the money)

Calculation: $0.59 / $21.92 X 100 = 2.7% Yield

ASX Call Options data is available each day in financial papers and online. Look under Derivatives – Share Options / CALL OPTIONS. There are about 70 companies listed each day and each company may have a few to several options listed. You should only need to compare the in, out, and at the money options for each company. This equates to a few hundred options and you could look for the best available option returns. The above data and completed calculations are also available in Smart Report format in My Covered Calls and ProWriter software.

Trend

Trading Plan

Trading Diary

Trade

Note the live share price and note the corresponding option premium last sale live price. If you are still happy with the share price and the current option premium (i.e. the available yield) then buy the shares as detailed in your plan as close to the share price and deduct the cost from your bank. The share price may have moved up or down as volatile stocks frequently open at a different price to their close, however, if you have already established the Yield is acceptable and the Trend is appropriate then make the decision to continue to trade your plan.

Sell the options as detailed in your plan, depositing the premium to your [virtual] bank. Watch the market to see if you are exercised or not at the expiry of the option, which may be toward the end of the month. The expiry date is the last date on which the option can be exercised.

Practice

Practise paper trades following the yield, trend, plan, diary, trade steps, using the data from My Covered Calls reports in the Member’s area or ProWriter software; and your trading dairy, and live market prices.

Trading Data

ETO’s or Exchange Traded Options are traded on a screen based trading system called the Derivatives Trading Platform (DTP). ETO orders are created on ASX Participant’s DTO computers and sent to all ASX Participant’s screens via the ASX’s host computer. The trading data is managed by the ASX host computer and is distributed to brokers, information vendors etc. Information can be real time, 20 minute delayed, end of day or other variants.

Paper Trading can be achieved by using data obtained from newspapers or some trading platforms, or conveniently read from the My Covered Calls Smart Reports which can be viewed on-line and downloaded, and printed if needed. For this example I will assume we are using My Covered Calls and the Smart Reports or ProWriter software.

My Covered Calls is free to join, and you get free support, and a 7 day free trial. Just go to www.mycc.com.au and follow the subscription prompts.

Successful Call Writing

Successful call writing is measured by getting consistent monthly cash flow from high returns. How is this achieved? By knowing which “blue chip” shares have the highest option yield, knowing these companies share price trend, and making a simple yet effective plan before entering the market. Then, trade the plan.

My Covered Calls uses ASX data to create smart reports that show the highest yields and lets you quickly compare deals in, out and at the money. Share price trends can be instantly viewed from within the reports, by clicking the respective company name. Dividend yield of a stock, its financial forecast(s) and buy, sell or hold adviser recommendations can be obtained from online platforms. I use Comsec, for the last 15 years, and find it is excellent.

Part 2. My Covered Calls Strategy (The Five Steps) Explained

My Covered Calls strategy comes from using the yield and trend and planning all trades, every time; and trading the plan. Once you enter the market you can follow the live movement of the companies you have nominated in the plan, and buy shares and sell options as close to the plan as possible. This strategy has consistently achieved results. Keep good records, in your diary, to measure your results.

My Covered Calls follows a strategy which is covered by the following topics, namely:

Yield – find the highest option yield(s) available from all ASX stocks

Trend – note the underlying company’s share price trend

Plan – do a trading plan, every time

Diary – use a trading diary to mitigate emotion and keep accurate records

Trade – trade on-line or personal broker

Yield - find the highest option yields available

Determine the best call option deals available on the ASX by reviewing the current top option yields. This can be done by logging into MyCC and reviewing the tabulated reports. Look at the All Options by Company report (select current month), which shows all yields for all companies for this month and automatically calculates the % return [Yield] for At, In and Out of the Money. You can quickly scroll through the report to see the high yield company options in, out and at the money. The yield is shown under the Not Exercised and Exercised % Return column.

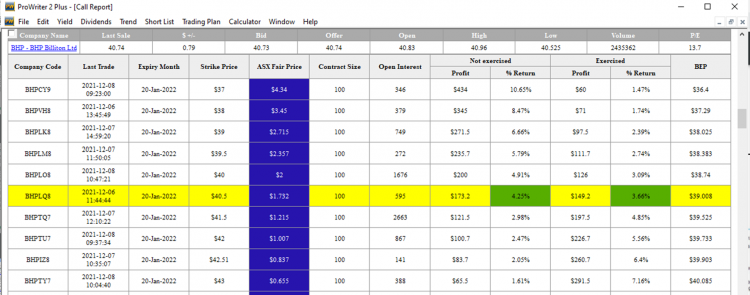

The Smart Reports show a yellow row as close to at-the-money as mathematically possible. At the money is when the Strike price is at or near the underlying company’s share price. The blue shading allows you to quickly compare Exercised or Not Exercised profits.

Look for yield returns of say 2.0% to 2.5%, per month. For example shown below is an extract from ProWriter showing BHP’s Yield for Jan 2022. You can see BHP today’s prices here: MyCC Smart Report BHP

Trend - note the underlying company’s share price trend

Share Price Direction

We need to determine the trend of the underlying stock’s share price as writing covered calls appears optimal in a gentle bullish market to sideways market. A quick look at the underlying company’s share price history, can give us a sound indication of the stock’s price movement; up, down or sideways. Share price history can be displayed graphically using its recent price history charts. MyCC has included price history charts in the smart reports. When you are reviewing the reports, just click on the Company Name, in the report, and the chart shown below, or similar, should appear:

The chart above shows that BHP share price is trending upward since Nov 2021. I also like to take a longer view of the price trend.

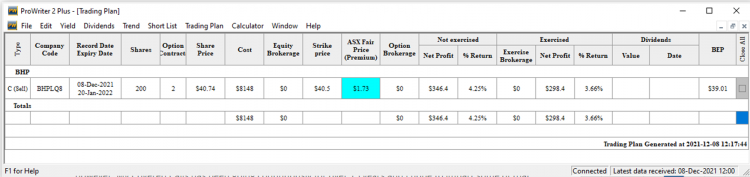

Plan – do a trading plan, every time

Trading Plan

Having reviewed the yield and noted the trend of a few likely companies; next you should write a Trading Plan. This can be done in tabulated form using a spreadsheet. The plan shows you the various choices you can make regarding [share] entry point, Strike and Premium, and shows you the profit Exercised or Not Exercised. Here is where you make an informed decision about the share(s) you are happy to hold and the call(s) you may write.

Print the plan and consider your choices, reviewing the trend and any other [fundamental] information such as company announcements, news items, reports, world events like oil prices etc.

An example Trading Plan is shown below. Please note brokerage costs not included:

Diary – use a trading diary

Trading Diary

A trading diary can be used to keep a record of your cash at bank, share purchases, call option sales, other trading information and anything else you think appropriate. You can use your diary to document your thinking or to do what-if scenarios. Paper trading relies on an accurate Trading Diary to see your return on your virtual investment. Paper trading should be as close to live trading as possible. Keeping accurate records helps create this realism.

Trading Platform

If you have a Comsec, Etrade, Options Express or other on-line trading platform, go on-line and use live prices to [virtually] buy the shares and sell the options as detailed in your plan. It’s a good idea to print out your trading plan a place it in plain view, next to your keyboard or on a copy holder (works well),

Live Share and Option Prices

Current share and option prices can also been seen on the ASX’s web pages for shares and option prices. These pages are very good and display 20 minute delayed data. You should use live prices to get the most realism and the best experience out of paper trading. Use the live prices to determine what prices you could have purchase the underlying shares at and Premium received.

Record the share purchase prices in your diary, which can include a spread sheet for recording data. Note the strike you plan to sell the call at and use live prices to record the current premium, you would have received at that strike.

Bank Account

Open a [virtual] bank account and deposit your working capital. As you buy and sell shares and options you can record the debits and credits against this account. There is an old saying that “if you don’t know how much money you have made, you have probably lost it”. Keeping an accurate bank account, as part of your trading diary, is an excellent metric to use to measure your success at paper trading. When you go live keeping accurate records is mandatory, for tax records etc.

Higher Risk

If you wish to trade more aggressively and are happy to accept greater risk, then note the strike price you are happy to sell a call at and consider the premium spread. That is the range between the lowest premium bid and the highest premium offer. Decide on the premium you want to achieve and how long you are prepared to wait for it (before accepting a lower bid). Write these variables down in your diary.

Watch or review the premium prices at the strike you have selected and write down when you achieve it. Add this amount to your bank account.

Please note; while you hold the underlying shares their price may go up, down or sideways which will be reflected in the premium price. The above strategy would usually be based on your assessment the underlying stock price is in an upward trend.

Time Efficient

Writing covered calls is not only considered a low-risk instrument to trade, it is also very time efficient. You don’t need to watch the market for eight hours a day; not take a day off because of open positions, or have updates sent to your mobile phone. In fact using MyCC Smart Reports you can quickly scan all options available for the best deal (also on your phone), review the underlying company’s share price trend, create a trading plan and diary, and buy the underlying shares and write a call option(s); in less than a couple of hours. Then be patient until the end of the month and see if you were exercised or not.

However, it is good practice to allow a couple minutes each day to go through the MyCC reports and note which companies regularly have the highest yields and best trends. It takes about ½ a minute to log in to MyCC, particularly with the new Member’s access on the title page; and about 5 minutes to scroll through the All Options By Company Current Month Smart Report. Do this while you are checking your emails or taking a coffee break. Make a note of companies you would like to keep your eye on. This quickly builds your experience.

Follow the Market

You can now follow the market until the option expires (call day) and see what profit you would have made.

It is very good practice to use the MyCC Smart Report View Selected Stocks Current Month and select the companies you are trading options in and record the daily last share price, strike you sold at, and the premium. Do this each day (or at least every couple of days). This habit makes paper trading, in particular, very effective as you see two very relevant things:

Record the movements (price, strike and premium) in your diary or under your trading plan and look for price trends. This is a bit hands on, but it is what builds your experience.

Any business, no matter what business it is must be concerned with getting a return on investment or value for money. Follow the market as often as you can, without letting it overwhelm you, and you will get your capital investment working for you as you write covered calls.

Trade – trade on-line or personal broker

Broker

Use your broker and/or trading platform to buy shares and write calls.

When you first start to trade you will have many questions.

A good book to read is Trading Secrets by Louise Bedford. PS I have no affiliation with Louise Bedford...I just like to book, good chapter on Covered Call Options.

Coming soon: "How to Paper-trade with My Covered Calls and Comsec "

* I use Comsec to trade on-line. You can set up a Comsec options account (level II for Covered Call options) for free. Once you hacve you account set up with Comsec you can log in and enter the Option Series Code shown as the Company Code in ProWriter and MyCC Reports; and see the live bid and offer prices whihc you can easily type into ProWriter which caculates the actual outcomes both Excercised and Not Exercised. There are no other outcomes.

Click to see live BHP, BSL & TLS sample smart report showing Not-Exercised and Exercise Returns. All Companies available in Members Area.

Tony Osborn - Team of One

MyCC is provided as a service to its members. Small, niche, exclusive and operated since 2006.

© My Covered Calls Pty Ltd. All rights reserved. ACN: 125 141 344