Customer Service Hotline: 0408 763 663

A covered call option is a financial market transaction, enforced by a contract, in which the seller of the call option owns shares or other securities, covering the value of the contract.

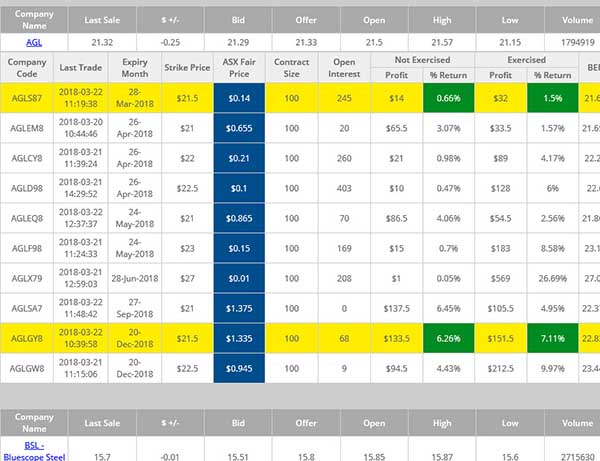

An option is the right to buy shares from someone who has an obligation to sell you the shares. You can sell this 'right', under an option contract, and receive a payment if the form of a Premium which you get to keep. Its like selling a contract to someone to buy the shares from you at a time they choose; usually at an agreed price, and within the contract period. Your payment the Premium could be 2% to 2.5% for a contract period of say a month. See the Smart report to the right of the screen, to see a live example of the returns currently available on BHP, BSL and TLS. If you own or buy the underlying shares before you sell the option then this is call a "Covered Call Option" because the shares are available to sell to the buyer if they decide to buy them or the contract gets 'Exercised'. If you don't own the underlying security then it is a "naked" option. I wouldn't go naked as I would feel exposed...

If you buy the shares at the same time as you sell the call option then the strategy is often called a "buy-write" strategy.

Owning the underlying shares is said to provide the "cover" as the shares can be delivered to the buyer of the call option if the buyer decides to 'exercise' the contract.

Writing a call option generates income from the 'Premium' paid by the call option buyer.

You can buy shares on the Australian Stock Exchange (ASX)… also known as the stock market. Or if you already own shares, then you can sell an option to someone else who might buy your shares from you later on, usually if the price goes up. You're ok with this, in fact you are delighted with this because you are happy to sell the shares at the price you agreed in the contract and because the money you get for selling the option contract may well be 2% to 2.5% of the value of the shares you bought in the first place; and the option contract period may only be a month! 2% to 2.5% return in a month is not bad. You are not likely to sell an option contract on the same shares consistently every month at the same Strike price as shares prices go up and down. However, you may regularly sell (write) call options over shares you own, or buy, (covered calls).

You can also buy an "option" from someone else, who already owns shares, to buy their shares later on; if you choose to. For example, if the share price goes up and you have an option contract to buy them at a cheaper price then, you would most likely buy the shares at the cheaper price and then sell them back to the market, at the current higher price, and make a profit. These people are our covered call customers because they buy the option...and pay us a Premium; I call income.

Click to see live BHP, BSL & TLS sample smart report showing Not-Exercised and Exercise Returns. All Companies available in Members Area.

Tony Osborn - Team of One

MyCC is provided as a service to its members. Small, niche, exclusive and operated since 2006.

© My Covered Calls Pty Ltd. All rights reserved. ACN: 125 141 344